“Thoughtful financial planning can easily take a back seat to every day life”

Behaviours of financial literacy (22)

Financial Literacy is often mistaken for Business Acumen. Financial literacy is a critical capability, yet interestingly it is one of the easiest capabilities to buy (accountants, financial advice etc). Financial Literacy as used in the Business Acumen Gauge is divided into two sections: Understanding Financial Data and Interpreting and Applying Financial Data.

Understanding Financial Data is concerned with the degree to which a leader understands terminology and can read financial documents. Interpreting and Applying Financial Data is concerned with a leader's capacity to read the story financial data is telling and effectively apply it to business operations. Example behaviours are outlined below.

financial literacy (a) behaviours include:

understands the key elements of a profit and loss statement

This behaviour is applied literally. To what degree does a leader actually understand and demonstrate their understanding of the key elements of a profit and loss statement (see sample below).

This sample result could highlight the participant:

- Communicates insights to colleagues and direct reports proficiently but neglects communication with management

- Is unaware of and/or not meeting the expectations of management

understands margins (cost of sales) and their significance

This capability measures a simple yet fundamental piece of financial literacy. Take, for example, the Sales Manager who increases commission to drive sales volume with little or no consideration of the impact on cost of sales. Or the manager who defaults to increased marketing spend to drive leads and sales only to realise that though sales continue to rise overall profitability is plateauing.

financial literacy (B) behaviors:

Is able to justify budgets within the overall strategy

Strategy is a mixture of data informing action. As such this behaviour highlights a leaders ability to interpret financial data, understand where the insights drawn from the data fit into organisational strategy and then align their own budgets and the outcomes of their spending with the broader organisational intent.

uses financial information to guide/motivate self and others in decision making

For some leaders the ability to have financial data inform decision making is paramount. Yet often financial information is not shared with the broader business but rather is silo'd (i.e. with senior finance managers). This behaviour allows you to clearly and pragmatically asses the degree to which leaders are using financial information proactively to guide and motivated decisions with self and others.

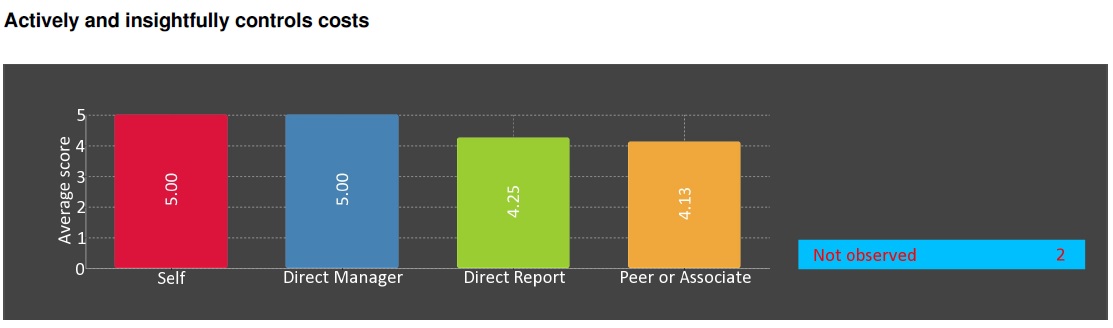

Actively and insightfully controls costs

Cost cutting can be a knee jerk reaction or a systematic process. Cost control requires a delicate balance between an objective to keep costs down and a recognition of the need to spend money to make money. This behaviour, therefore, measures how wisely (insightfully) and proactively a leader manages cost (see sample below).

This sample report could highlight the participant:

- Has an excellent grasp on cost and controlling mechanisms

- Has great communication skills to ensure everyone understands cost controls

- Would make a good mentor for lesser experienced leaders in the organisation